Credit Counselling with EDUdebt: Trusted Solutions for Singapore Locals

Credit Counselling with EDUdebt: Trusted Solutions for Singapore Locals

Blog Article

The Value of Credit History Counselling: A Comprehensive Guide to Improving Your Financial Health

Debt coaching serves as an essential resource for individuals looking for to improve their economic wellness, providing customized methods and insights that resolve particular monetary obstacles. By assisting in a much deeper understanding of budgeting, financial obligation monitoring, and financial institution settlement, credit history counsellors encourage customers to navigate their monetary landscape with better self-confidence.

Understanding Credit Counselling

Credit score counselling acts as a crucial resource for people facing debt management and economic literacy. It includes a procedure where trained experts offer guidance and education to assist clients comprehend their economic scenarios, develop budgets, and produce plans to handle financial debt effectively. Credit counsellors assess a person's financial health and wellness by taking a look at income, expenditures, and existing financial obligations.

The primary objective of credit rating coaching is to equip individuals with the knowledge and abilities essential to make educated monetary decisions. This often consists of enlightening customers concerning credit rating, interest prices, and the implications of various types of debt. In addition, debt coaching can help with communication in between customers and lenders, possibly bring about more positive settlement terms.

It is necessary to acknowledge that credit score therapy is not a one-size-fits-all service; the approach can differ substantially based on specific scenarios and requirements. Customers are motivated to engage actively in the procedure, as their engagement is critical for attaining lasting monetary security. By cultivating an understanding of economic concepts and accountable practices, debt therapy lays the foundation for a much healthier financial future.

Benefits of Credit Therapy

One of one of the most significant advantages of debt counselling is the tailored assistance it offers to individuals dealing with monetary difficulties. This customized approach makes sure that customers receive assistance particular to their one-of-a-kind monetary scenarios, enabling them to make enlightened decisions regarding their debts and expenses. Credit report counsellors analyze customers' monetary health and wellness, helping them recognize underlying concerns and establish workable plans to enhance their situations.

Furthermore, credit history counselling supplies education and learning on effective budgeting and finance strategies. Customers acquire beneficial understandings right into their investing habits, equipping them to make better financial choices moving on. This academic part not just aids in immediate debt resolution yet likewise fosters long-term financial literacy.

An additional secret benefit is the potential for working out with creditors. Credit rating counsellors often have actually established relationships with economic establishments, allowing them to support on behalf of their clients for reduced rates of interest or more convenient payment terms. This can result in significant cost savings over time.

Inevitably, credit history therapy can ease the psychological stress related to economic troubles. By outfitting people with the devices and sources they need, it promotes a feeling of empowerment, assisting them reclaim control over their economic futures.

Just How Credit Scores Coaching Functions

Engaging with a credit counselling solution commonly begins with a first assessment, where an experienced credit counsellor evaluates the client's monetary situation. Throughout this assessment, the counsellor gathers in-depth details pertaining to income, expenses, debts, and overall monetary practices. This detailed understanding makes it possible for the counsellor to identify the underlying issues contributing to monetary distress.

Adhering to the analysis, the counsellor functions collaboratively with the customer to develop a customized activity strategy intended at boosting economic wellness. This strategy might consist of budgeting techniques, debt administration methods, and suggestions for debt rebuilding. The counsellor provides guidance on focusing on financial debts, bargaining with financial institutions, and checking out prospective services such as debt management programs or economic education and learning sources.

Clients are encouraged to actively join the process, promoting responsibility and dedication to the agreed-upon methods. Normal follow-ups are typically set up to evaluate development and make essential adjustments to the strategy. Eventually, site link credit report coaching works as a crucial source, empowering clients to regain control of their finances, enhance their click for more creditworthiness, and attain long-lasting economic security.

Picking the Right Credit History Counsellor

Selecting an appropriate credit scores counsellor is a critical action in dealing with economic challenges properly. The best counsellor can provide useful insights, assistance, and customized strategies to assist you regain control of your monetary situation - credit counselling services with EDUdebt. When selecting a credit report counsellor, consider their credentials and experience. Try to find qualified professionals associated with reliable companies, as this shows a commitment to ethical methods and recurring education and learning.

In addition, analyze their solutions and approach. Some counsellors provide detailed economic education and learning, while others focus on particular problems like financial debt management or budgeting. It's important to find a counsellor who aligns with your particular demands and convenience degree.

Expense is an additional crucial aspect. Lots of charitable credit scores therapy agencies provide services at little to no charge, while others might bill costs. Always ask regarding these charges upfront click for source to prevent unanticipated costs.

Additionally, count on your instincts; an excellent relationship with your counsellor can improve the efficiency of your sessions. Consider looking for suggestions from good friends or household who have actually had positive experiences with credit scores counselling. Inevitably, putting in the time to select the best credit report counsellor can result in meaningful enhancements in your financial wellness.

Actions to Improve Your Financial Wellness

Next, produce a reasonable spending plan that aligns with your monetary objectives. Prioritize essential costs while recognizing discretionary costs that can be reduced. Carrying out a budgeting tool or application can enhance monitoring and responsibility.

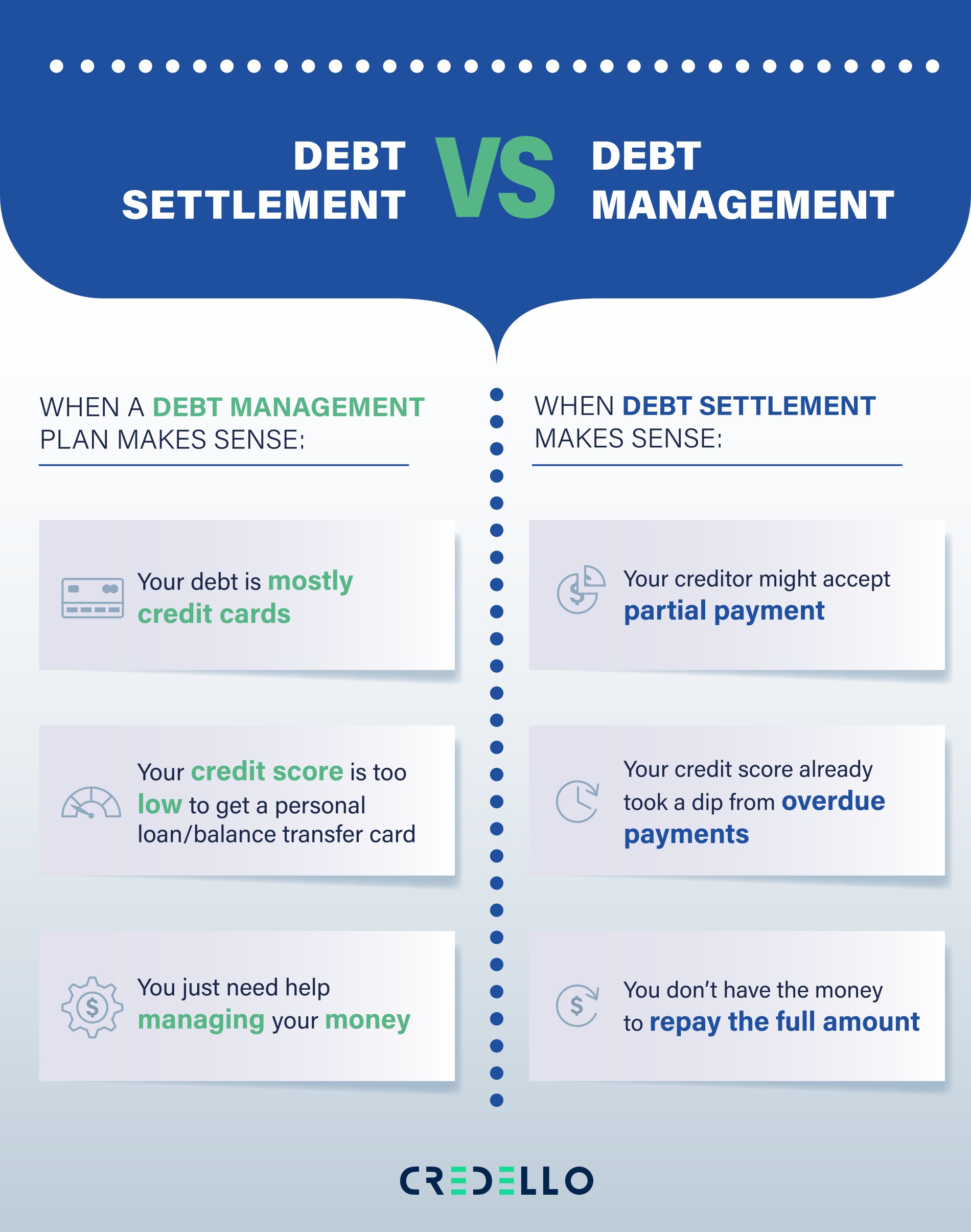

Financial obligation administration is another vital element. credit counselling services with EDUdebt. Take into consideration combining high-interest financial debts or discussing with creditors for much better terms. Establish a settlement plan that enables consistent repayments, reducing overall financial debt problem over time

Constructing an emergency fund must also be a priority. Goal to conserve at the very least 3 to 6 months' worth of living expenses to cushion against unforeseen monetary obstacles.

Verdict

Engaging with a certified debt counsellor not just decreases financial stress and anxiety however likewise fosters liability, eventually contributing to an extra safe and secure and secure monetary future. The value of credit therapy can not be overemphasized in the quest of economic health.

Involving with a credit score counselling service commonly begins with a preliminary examination, where an experienced credit scores counsellor examines the customer's economic situation. Ultimately, credit score counselling serves as a vital source, empowering clients to restore control of their funds, boost their creditworthiness, and accomplish lasting economic stability.

Report this page